Payroll

Payroll

Payroll

Payroll

How To Calculate Overtime in the UAE As Per Labour Law (2026)

Published Date

Dec 12, 2025

Last Updated

Dec 12, 2025

Overtime pay in the UAE is governed by specific labour laws, and understanding how it is calculated is essential for both employees and employers. Whether you are working additional hours during the week, on rest days, or on public holidays, the rules around overtime can vary depending on your role and working arrangements.

This guide explains how overtime is calculated in the UAE for 2026, helping you ensure you are paid correctly and remain compliant with local labour regulations.

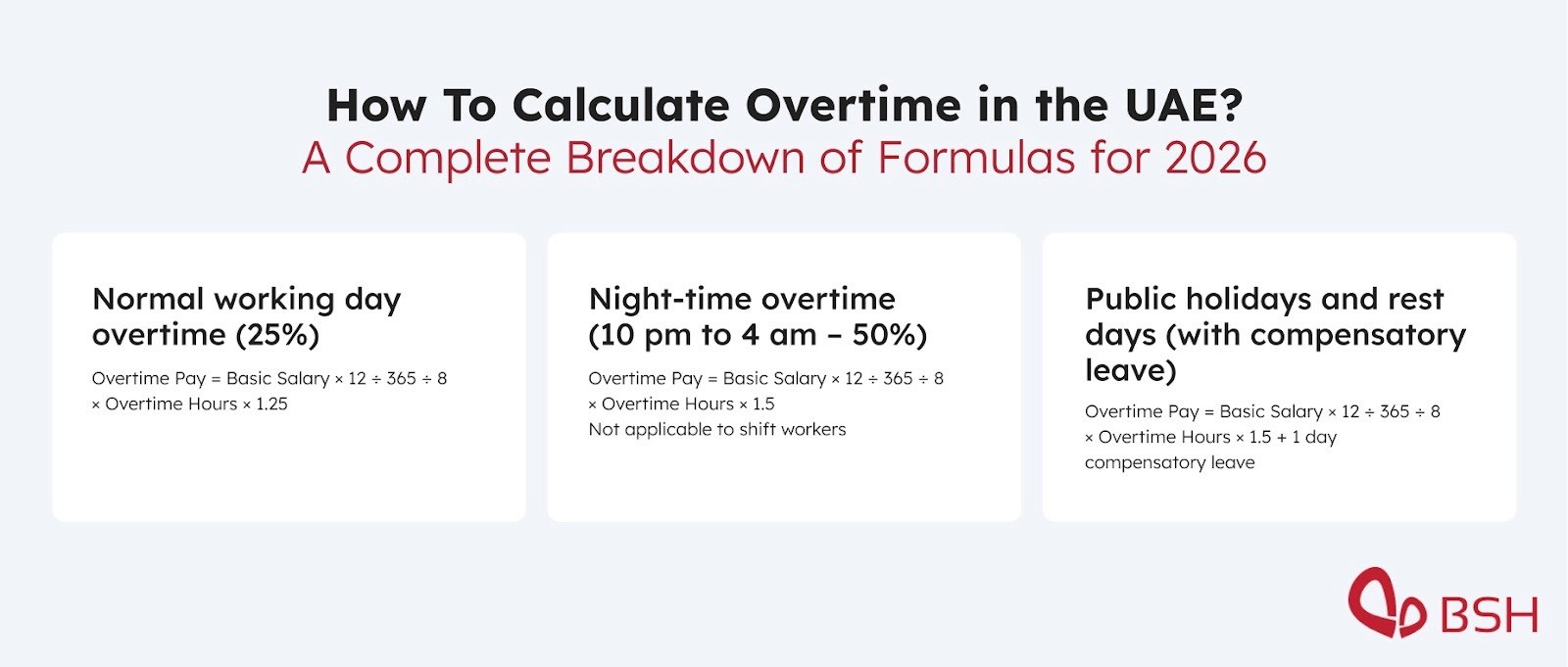

How Is Overtime Calculated in the UAE?

Under UAE Labour Law, overtime pay is always calculated using an employee’s basic salary, excluding allowances. For standard overtime, employees are entitled to an additional 25% on their hourly rate. If overtime is worked between 10 pm and 4 am, the overtime rate increases to 50%, reflecting the unsociable hours involved.

What Counts as Overtime Under UAE Labour Law?

Overtime refers to any hours worked beyond an employee’s normal working schedule. Under UAE Labour Law, these additional hours must be paid at a higher rate than standard working hours to ensure fair compensation.

The aim of overtime regulations is to recognise employees’ extra effort while preventing excessive or unfair working practices. According to Article 17 of Federal Decree Law No. 33 of 2021, the standard working hours in the UAE are eight hours per day or 48 hours per week.

Any work carried out beyond these limits is treated as overtime and must be compensated accordingly. However, employees working in sectors such as trade, hotels, and security services may work up to nine hours per day, depending on the nature of their role.

What Types of Overtime Are Recognised in the UAE?

What Is Force Majeure Overtime?

Force Majeure Overtime occurs when employees are required to work extra hours to address urgent or exceptional situations, such as unforeseen damages or emergencies that demand immediate attention. This type of overtime is generally not limited by law, given the extraordinary nature of the circumstances.

What Is Structural Overtime?

Structural Overtime refers to additional hours worked due to unexpected operational demands, such as peak workloads or temporary surges in business activity. Labour laws usually set a maximum limit on the number of structural overtime hours employees can work per week, ensuring that workloads remain reasonable under normal business conditions.

What Factors Are Used to Calculate Overtime Pay?

Calculating overtime in the UAE follows a formula outlined in Articles 67–72 of the Labour Law. The key components for determining overtime pay include:

The employee’s basic salary

The number of overtime hours worked

The type of overtime, whether it occurs on a normal working day, a Friday, or a public holiday

With these factors in mind, we can now explore how to calculate overtime in the UAE using the appropriate formulas for different situations.

How Is Overtime Calculated on a Normal Working Day?

If an employee works beyond their regular hours, they are entitled to their normal wage plus 25% extra for the overtime hours.

Formula

Per Day Wage = Basic Salary × 12 ÷ 365

Hourly Rate = Per Day Wage ÷ 8 (normal working hours)

Overtime Pay = Hourly Rate × Overtime Hours × 1.25

Example:

Basic Salary: AED 3,200 per month

Overtime Hours: 100

Per Day Wage = (3,200 × 12) ÷ 365 = AED 105.20

Hourly Rate = 105.20 ÷ 8 = AED 13.15

Overtime Hourly Rate = 13.15 × 1.25 = AED 16.43

Total Overtime Pay = 100 × 16.43 = AED 1,643

Total Monthly Salary = 3,200 + 1,643 = AED 4,843

How Is Night-Time Overtime (10 pm to 4 am) Calculated?

For overtime worked between 10 PM and 4 AM, employees receive their normal hourly rate plus 50%. This does not apply to shift workers.

Formula:

Per Day Wage = Basic Salary × 12 ÷ 365

Hourly Rate = Per Day Wage ÷ 8

Overtime Pay = Hourly Rate × Overtime Hours × 1.5

Example:

Per Day Wage = AED 105

Hourly Rate = 105 ÷ 8 = AED 13.12

Overtime Hourly Rate = 13.12 × 1.5 = AED 19.72

Total Overtime Pay = 100 × 19.72 = AED 1,972

Total Monthly Salary = 3,200 + 1,972 = AED 5,172

How Is Overtime Calculated on Public Holidays and Rest Days?

Overtime on public holidays in the UAE is slightly different from normal days. According to Article 81 of the UAE Labour Law, if an employee works on a public holiday or a rest day, they are entitled to compensatory leave plus a bonus of 50% of their hourly pay.

If the compensatory leave is not granted, the employer must pay 150% of the employee’s normal pay for the hours worked.

Formula

Total Overtime Pay = Basic Salary × 12 ÷ 365 ÷ 8 × Overtime Hours × 1.5 + 1 day compensatory leave

Example:

Basic Salary: AED 3,200

Overtime Hours: 8

Total Overtime Pay = 3,200 × 12 ÷ 365 ÷ 8 × 8 × 1.5 = AED 157 plus 1 day off

If the compensatory leave is not given, the pay rises to 150% of the normal rate:

Total Overtime Pay = 3,200 × 12 ÷ 365 ÷ 8 × 8 × 2.5 = AED 263

This ensures employees are fairly compensated for working on public holidays, either through pay or time off.

What Are the Most Common Overtime Calculation Mistakes Employers Make?

Most employers in the UAE make a genuine effort to comply with overtime calculation requirements and apply the correct formulas. However, errors still occur, and using the wrong method can result in compliance issues, disputes, or legal penalties.

Compliant employers typically calculate overtime using the following formulas:

Per Day Salary = Basic Salary ÷ 30

Per Hour Salary = Basic Salary ÷ 30 ÷ 8

Despite this, some organisations continue to apply incorrect calculations, such as:

Per Day Salary = Basic Salary × 12 ÷ 365

Per Hour Salary = Basic Salary × 12 ÷ 365 ÷ 8

Using incorrect formulas can lead to inaccurate overtime payments and potential non-compliance with UAE Labour Law.

What Overtime Rules Must Employers Follow in the UAE?

In addition to standard working hours, UAE Labour Law sets out clear rules that employers must follow when assigning overtime and calculating compensation. Key requirements include:

Employers may request overtime, but additional working hours must not exceed two hours per day.

When employees work beyond their normal hours, they are entitled to their regular pay plus 25%, which increases to 50% if the overtime is worked between 10 pm and 4 am. This does not apply to shift workers.

If employees are required to work on their rest days, employers must provide a compensatory day off or pay an additional 50% of the employee’s remuneration for that day.

Employees who work five consecutive hours or more of overtime are entitled to a minimum one-hour break, which is not counted as overtime.

While the standard working day in the UAE is eight hours, this is reduced to six hours per day during Ramadan.

Employees should not be asked to work for more than two consecutive weekend days, except for day workers.

Which Employees and Working Hours Are Exempt from Overtime Pay?

It is also important to note that some roles, such as senior and administrative positions, are exempt from overtime calculations. In certain cases, employees on maternity or paternity leave, night-shift workers, and those employed in maritime or marine industries may also be exempt, depending on applicable labour regulations.

Additionally, commuting time and breaks for meals or rest are not included when calculating overtime hours.

A Smarter Approach to Overtime Calculation with BSH Payroll

BSH offers customised payroll software and outsourced payroll solutions designed to simplify overtime calculations and ensure full compliance with UAE Labour Law. By automating complex payroll processes, BSH helps businesses improve efficiency, reduce errors, and maintain accurate employee records. This streamlined approach not only supports timely and transparent salary payments but also helps employers stay compliant, avoid penalties, and keep employees satisfied through fair and accurate compensation.

Overtime pay in the UAE is governed by specific labour laws, and understanding how it is calculated is essential for both employees and employers. Whether you are working additional hours during the week, on rest days, or on public holidays, the rules around overtime can vary depending on your role and working arrangements.

This guide explains how overtime is calculated in the UAE for 2026, helping you ensure you are paid correctly and remain compliant with local labour regulations.

How Is Overtime Calculated in the UAE?

Under UAE Labour Law, overtime pay is always calculated using an employee’s basic salary, excluding allowances. For standard overtime, employees are entitled to an additional 25% on their hourly rate. If overtime is worked between 10 pm and 4 am, the overtime rate increases to 50%, reflecting the unsociable hours involved.

What Counts as Overtime Under UAE Labour Law?

Overtime refers to any hours worked beyond an employee’s normal working schedule. Under UAE Labour Law, these additional hours must be paid at a higher rate than standard working hours to ensure fair compensation.

The aim of overtime regulations is to recognise employees’ extra effort while preventing excessive or unfair working practices. According to Article 17 of Federal Decree Law No. 33 of 2021, the standard working hours in the UAE are eight hours per day or 48 hours per week.

Any work carried out beyond these limits is treated as overtime and must be compensated accordingly. However, employees working in sectors such as trade, hotels, and security services may work up to nine hours per day, depending on the nature of their role.

What Types of Overtime Are Recognised in the UAE?

What Is Force Majeure Overtime?

Force Majeure Overtime occurs when employees are required to work extra hours to address urgent or exceptional situations, such as unforeseen damages or emergencies that demand immediate attention. This type of overtime is generally not limited by law, given the extraordinary nature of the circumstances.

What Is Structural Overtime?

Structural Overtime refers to additional hours worked due to unexpected operational demands, such as peak workloads or temporary surges in business activity. Labour laws usually set a maximum limit on the number of structural overtime hours employees can work per week, ensuring that workloads remain reasonable under normal business conditions.

What Factors Are Used to Calculate Overtime Pay?

Calculating overtime in the UAE follows a formula outlined in Articles 67–72 of the Labour Law. The key components for determining overtime pay include:

The employee’s basic salary

The number of overtime hours worked

The type of overtime, whether it occurs on a normal working day, a Friday, or a public holiday

With these factors in mind, we can now explore how to calculate overtime in the UAE using the appropriate formulas for different situations.

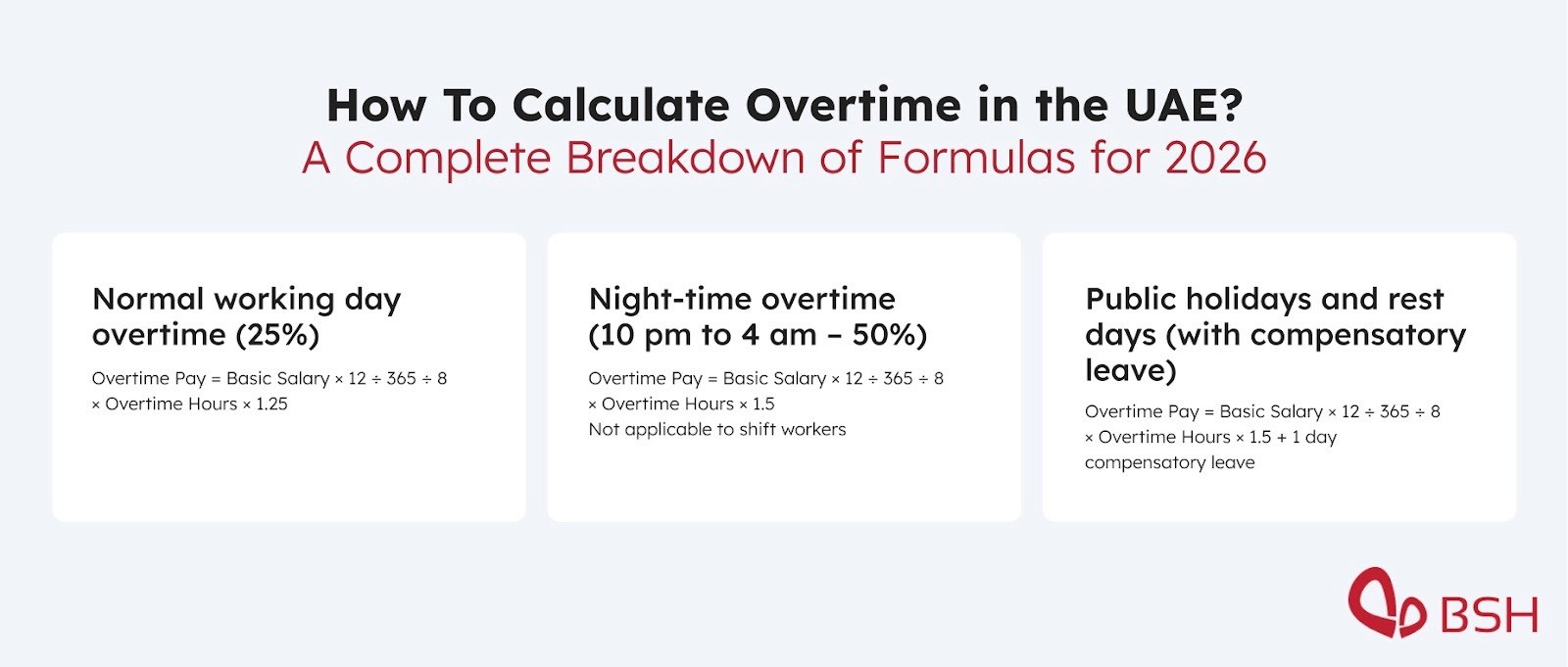

How Is Overtime Calculated on a Normal Working Day?

If an employee works beyond their regular hours, they are entitled to their normal wage plus 25% extra for the overtime hours.

Formula

Per Day Wage = Basic Salary × 12 ÷ 365

Hourly Rate = Per Day Wage ÷ 8 (normal working hours)

Overtime Pay = Hourly Rate × Overtime Hours × 1.25

Example:

Basic Salary: AED 3,200 per month

Overtime Hours: 100

Per Day Wage = (3,200 × 12) ÷ 365 = AED 105.20

Hourly Rate = 105.20 ÷ 8 = AED 13.15

Overtime Hourly Rate = 13.15 × 1.25 = AED 16.43

Total Overtime Pay = 100 × 16.43 = AED 1,643

Total Monthly Salary = 3,200 + 1,643 = AED 4,843

How Is Night-Time Overtime (10 pm to 4 am) Calculated?

For overtime worked between 10 PM and 4 AM, employees receive their normal hourly rate plus 50%. This does not apply to shift workers.

Formula:

Per Day Wage = Basic Salary × 12 ÷ 365

Hourly Rate = Per Day Wage ÷ 8

Overtime Pay = Hourly Rate × Overtime Hours × 1.5

Example:

Per Day Wage = AED 105

Hourly Rate = 105 ÷ 8 = AED 13.12

Overtime Hourly Rate = 13.12 × 1.5 = AED 19.72

Total Overtime Pay = 100 × 19.72 = AED 1,972

Total Monthly Salary = 3,200 + 1,972 = AED 5,172

How Is Overtime Calculated on Public Holidays and Rest Days?

Overtime on public holidays in the UAE is slightly different from normal days. According to Article 81 of the UAE Labour Law, if an employee works on a public holiday or a rest day, they are entitled to compensatory leave plus a bonus of 50% of their hourly pay.

If the compensatory leave is not granted, the employer must pay 150% of the employee’s normal pay for the hours worked.

Formula

Total Overtime Pay = Basic Salary × 12 ÷ 365 ÷ 8 × Overtime Hours × 1.5 + 1 day compensatory leave

Example:

Basic Salary: AED 3,200

Overtime Hours: 8

Total Overtime Pay = 3,200 × 12 ÷ 365 ÷ 8 × 8 × 1.5 = AED 157 plus 1 day off

If the compensatory leave is not given, the pay rises to 150% of the normal rate:

Total Overtime Pay = 3,200 × 12 ÷ 365 ÷ 8 × 8 × 2.5 = AED 263

This ensures employees are fairly compensated for working on public holidays, either through pay or time off.

What Are the Most Common Overtime Calculation Mistakes Employers Make?

Most employers in the UAE make a genuine effort to comply with overtime calculation requirements and apply the correct formulas. However, errors still occur, and using the wrong method can result in compliance issues, disputes, or legal penalties.

Compliant employers typically calculate overtime using the following formulas:

Per Day Salary = Basic Salary ÷ 30

Per Hour Salary = Basic Salary ÷ 30 ÷ 8

Despite this, some organisations continue to apply incorrect calculations, such as:

Per Day Salary = Basic Salary × 12 ÷ 365

Per Hour Salary = Basic Salary × 12 ÷ 365 ÷ 8

Using incorrect formulas can lead to inaccurate overtime payments and potential non-compliance with UAE Labour Law.

What Overtime Rules Must Employers Follow in the UAE?

In addition to standard working hours, UAE Labour Law sets out clear rules that employers must follow when assigning overtime and calculating compensation. Key requirements include:

Employers may request overtime, but additional working hours must not exceed two hours per day.

When employees work beyond their normal hours, they are entitled to their regular pay plus 25%, which increases to 50% if the overtime is worked between 10 pm and 4 am. This does not apply to shift workers.

If employees are required to work on their rest days, employers must provide a compensatory day off or pay an additional 50% of the employee’s remuneration for that day.

Employees who work five consecutive hours or more of overtime are entitled to a minimum one-hour break, which is not counted as overtime.

While the standard working day in the UAE is eight hours, this is reduced to six hours per day during Ramadan.

Employees should not be asked to work for more than two consecutive weekend days, except for day workers.

Which Employees and Working Hours Are Exempt from Overtime Pay?

It is also important to note that some roles, such as senior and administrative positions, are exempt from overtime calculations. In certain cases, employees on maternity or paternity leave, night-shift workers, and those employed in maritime or marine industries may also be exempt, depending on applicable labour regulations.

Additionally, commuting time and breaks for meals or rest are not included when calculating overtime hours.

A Smarter Approach to Overtime Calculation with BSH Payroll

BSH offers customised payroll software and outsourced payroll solutions designed to simplify overtime calculations and ensure full compliance with UAE Labour Law. By automating complex payroll processes, BSH helps businesses improve efficiency, reduce errors, and maintain accurate employee records. This streamlined approach not only supports timely and transparent salary payments but also helps employers stay compliant, avoid penalties, and keep employees satisfied through fair and accurate compensation.

Frequently asked questions

What does 1.25 overtime mean?

What does 1.25 overtime mean?

What does 1.25 overtime mean?

What does 1.25 overtime mean?

Is overtime calculated on basic salary or gross salary?

Is overtime calculated on basic salary or gross salary?

Is overtime calculated on basic salary or gross salary?

Is overtime calculated on basic salary or gross salary?

What can an employee do if overtime is not paid?

What can an employee do if overtime is not paid?

What can an employee do if overtime is not paid?

What can an employee do if overtime is not paid?

Is forced overtime legal in the UAE?

Is forced overtime legal in the UAE?

Is forced overtime legal in the UAE?

Is forced overtime legal in the UAE?

Can an employee refuse to work overtime?

Can an employee refuse to work overtime?

Can an employee refuse to work overtime?

Can an employee refuse to work overtime?

What are the minimum and maximum overtime hours per day?

What are the minimum and maximum overtime hours per day?

What are the minimum and maximum overtime hours per day?

What are the minimum and maximum overtime hours per day?

From our blog

Jan 23, 2026

The Importance of International Payroll Services in the UAE

Jan 16, 2026

What Is the Minimum Wage in Dubai? Guide for Employees (2026)

Payroll

Dec 12, 2025

How To Calculate Overtime in the UAE As Per Labour Law (2026)

BSH and the BSH logo are registered trademarks of Business Systems House FZ-LLC | ADP, the ADP logo, and Always Designing for People are trademarks of ADP, Inc.

BSH and the BSH logo are registered trademarks of Business Systems House FZ-LLC | ADP, the ADP logo, and Always Designing for People are trademarks of ADP, Inc.