Custom Bank Files

Custom Bank Files

Custom Bank Files

Custom Bank Files

Automate Salary Payments with Custom Bank Files: UAE Guide

Jun 6, 2025

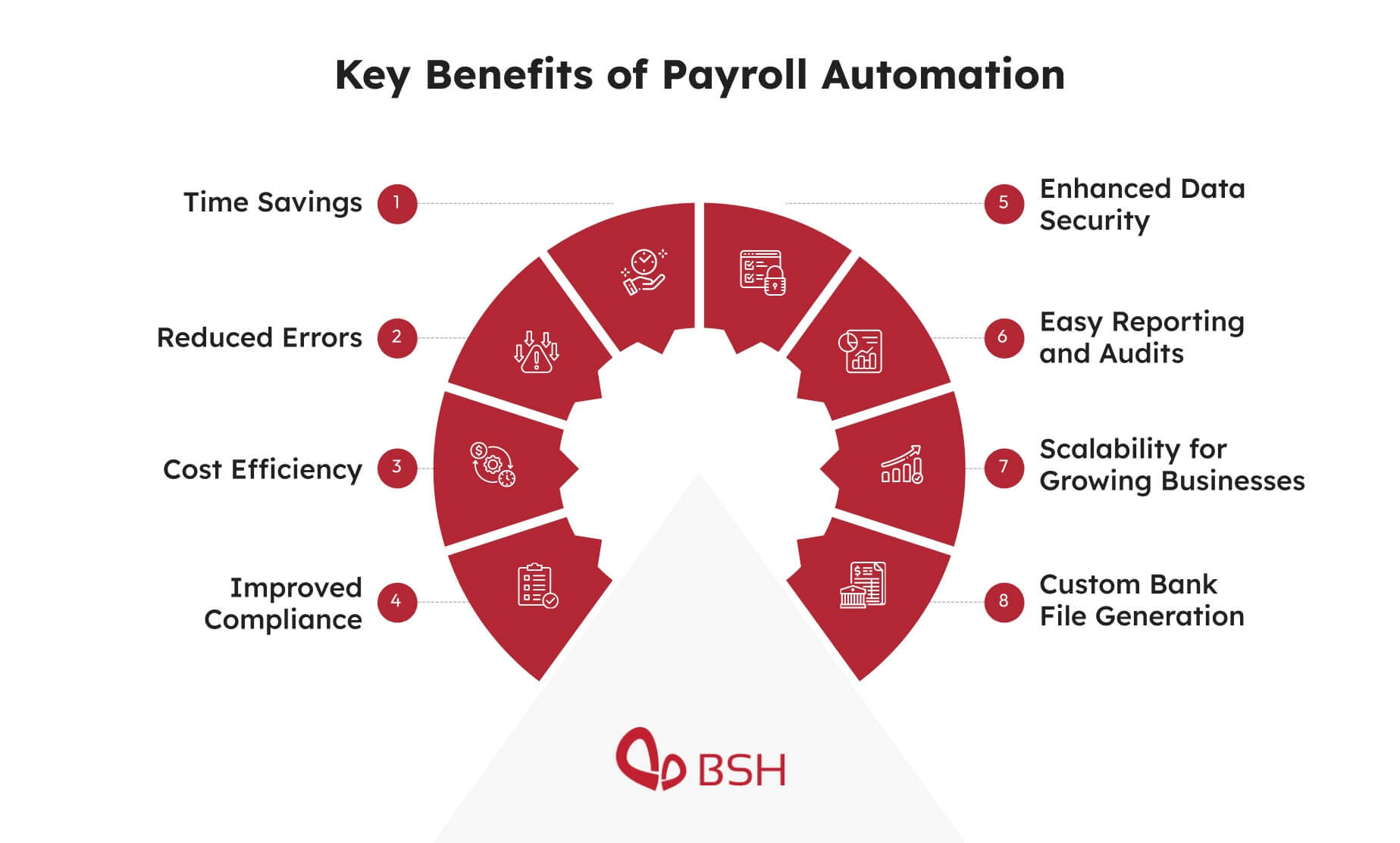

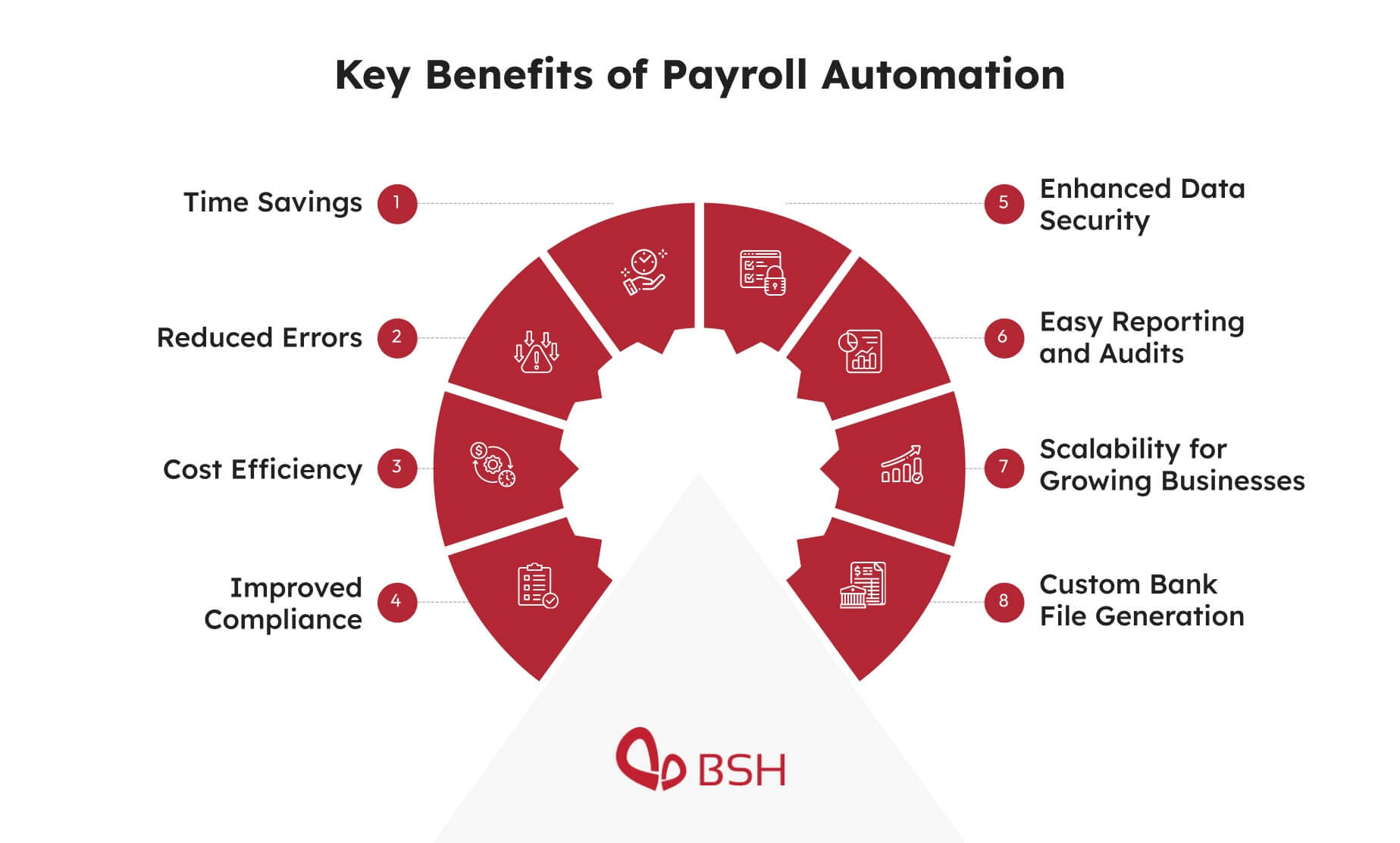

Payroll processing is a sensitive organisational function in general, as it is strictly regulated by law to uphold the rights of the workforce. Failing to adhere to them can result in negative consequences for a business and the overall reputation of a brand in the labour market.

Especially in the Middle East, there are government-mandated platforms that ensure timely payment of salaries, protect workers' rights, promote employer accountability, reduce disputes, enhance labour market transparency, and prevent the exploitation of vulnerable worker populations in the country. In the UAE, this framework is known as the WPS (Wage Protection System).

Additionally, errors, delays, or unfair salary disbursements can negatively impact employee satisfaction, increase turnover, and expose the business to legal risks.

Traditional, manual payroll methods are time-consuming and prone to mistakes, making them less suitable for growing or large-scale operations.

This blog explores how payroll automation with custom bank files offers a practical solution by streamlining the entire process, from salary calculation to payment execution. It highlights its role in simplifying secure and compliant salary transfers directly through integrated banking systems.

What Are Bank Files and Why Automate Them?

A bank file, in the context of payroll processing, is a thoroughly structured digital document that includes all the essential information required to accurately transfer employees' salaries. It typically includes data such as the employee's name, salary amount, bank details, and payment references.

These files are generated by payroll or accounting software, like the ones offered by BSH, to be compatible with the format specified by the bank. This includes formats such as CSV, TXT, or XML and is uploaded directly to the bank's online portal. Once the payroll is processed by the company, our software generates a bank file containing all the employee payment details in the format required by the bank.

Bank files act as a secure platform between the employer’s payroll system and the banking platforms. It simplifies automated bulk salary payments, eliminating the risk of manual data entry errors and inaccuracies, while also speeding up payment processing.

Most importantly, bank files allow organisations and the payroll department to maintain consistency and improve compliance with systems like the UAE’s WPS and the payroll law of a given country as a whole.

Custom Bank Files: The BSH Advantage

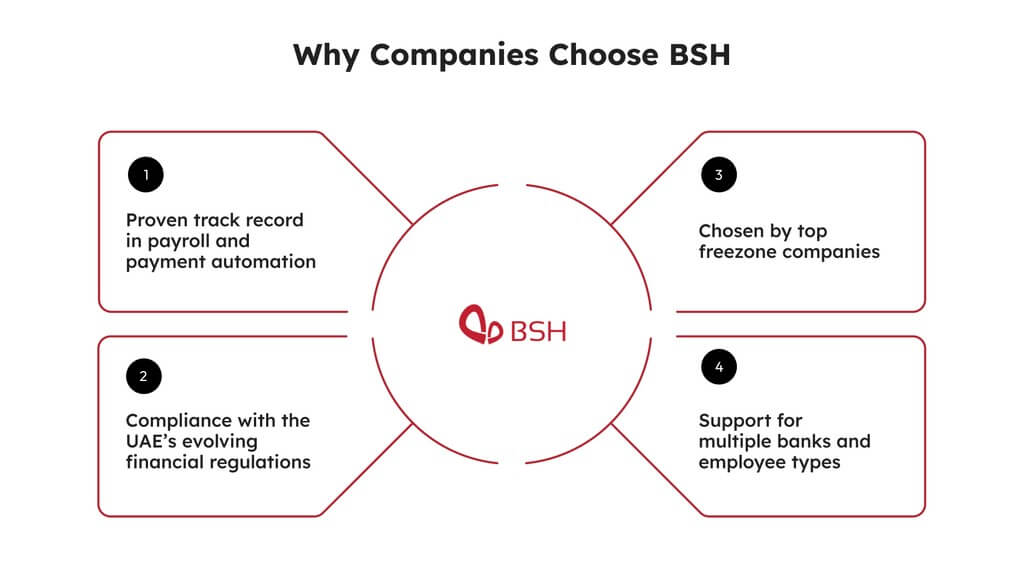

At BSH, we offer custom bank files that are ready-to-use and specifically designed to meet the bank's format requirements and its respective compliance standards. The customisation enables payroll teams to seamlessly integrate them with banking portals, making salary transfers simple, accurate, and efficient.

Whether you are having a business in the mainland or a free zone, our automated payroll solutions are tailored to support various regulatory requirements.

The files generated by our payroll software are fully compatible with multiple banks and payment structures, enabling payroll managers to upload them without requiring manual intervention.

Through our exclusively payroll-customised solutions, we guarantee businesses the confidence to process payroll in line with both UAE compliance guidelines and individual bank requirements.

Our HCM solutions are not restricted to the UAE only. With a consistent legacy spanning over 30 years, we stand as the premier provider of outsourced payroll and HCM solutions throughout the Middle East region.

All our services are customised to carefully reflect the legal frameworks of a given country, while incorporating the unique requirements of banks and the payroll policies of different companies.

What We Offer Through Custom Bank Files

Tailor-made bank file formats as per specific bank requirements (XML, CSV, TXT).

Compatibility with multiple UAE and international banks.

WPS (Wage Protection System) compliant files.

Automated validation to ensure error-free processing.

Ready-to-upload files for direct bank portal submission.

Solutions suitable for both mainland and free zone companies.

Secure handling of employee salary and bank data.

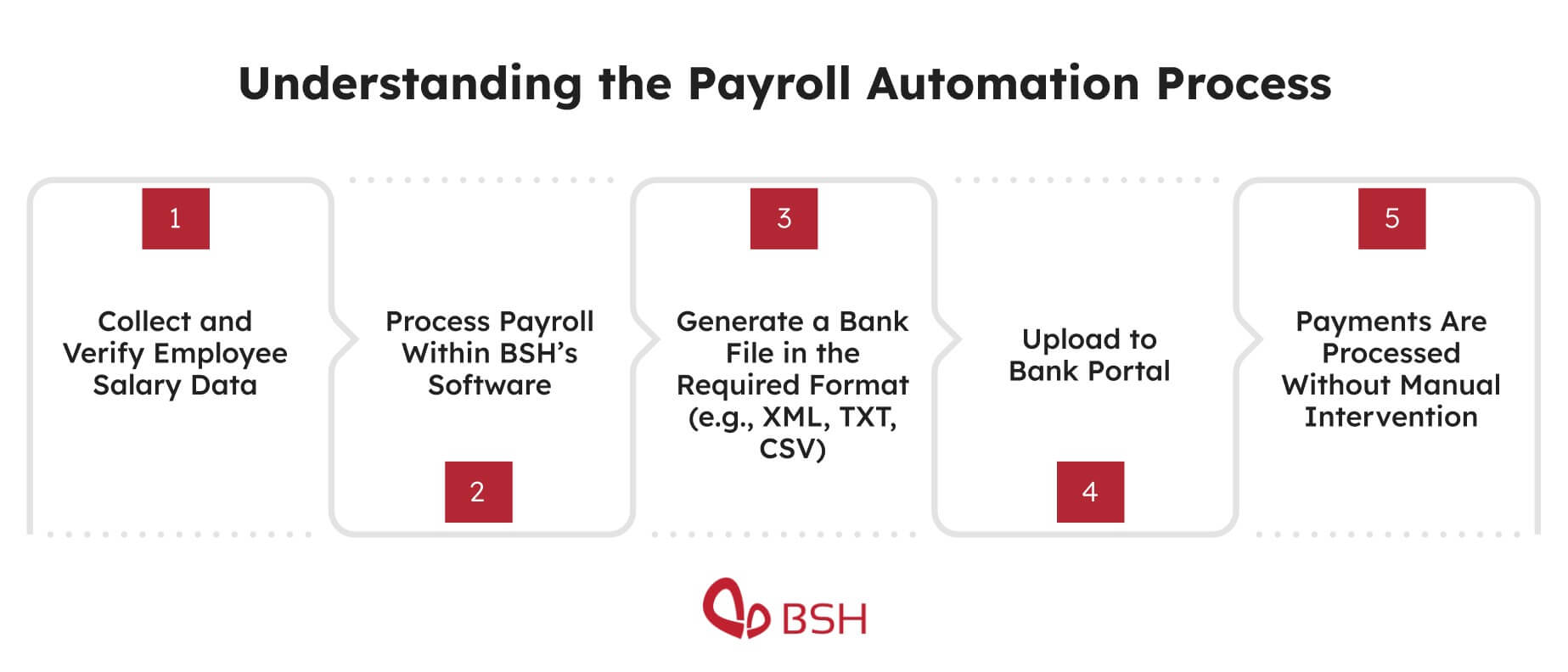

How Payroll Automation Works: Step-by-Step Guide

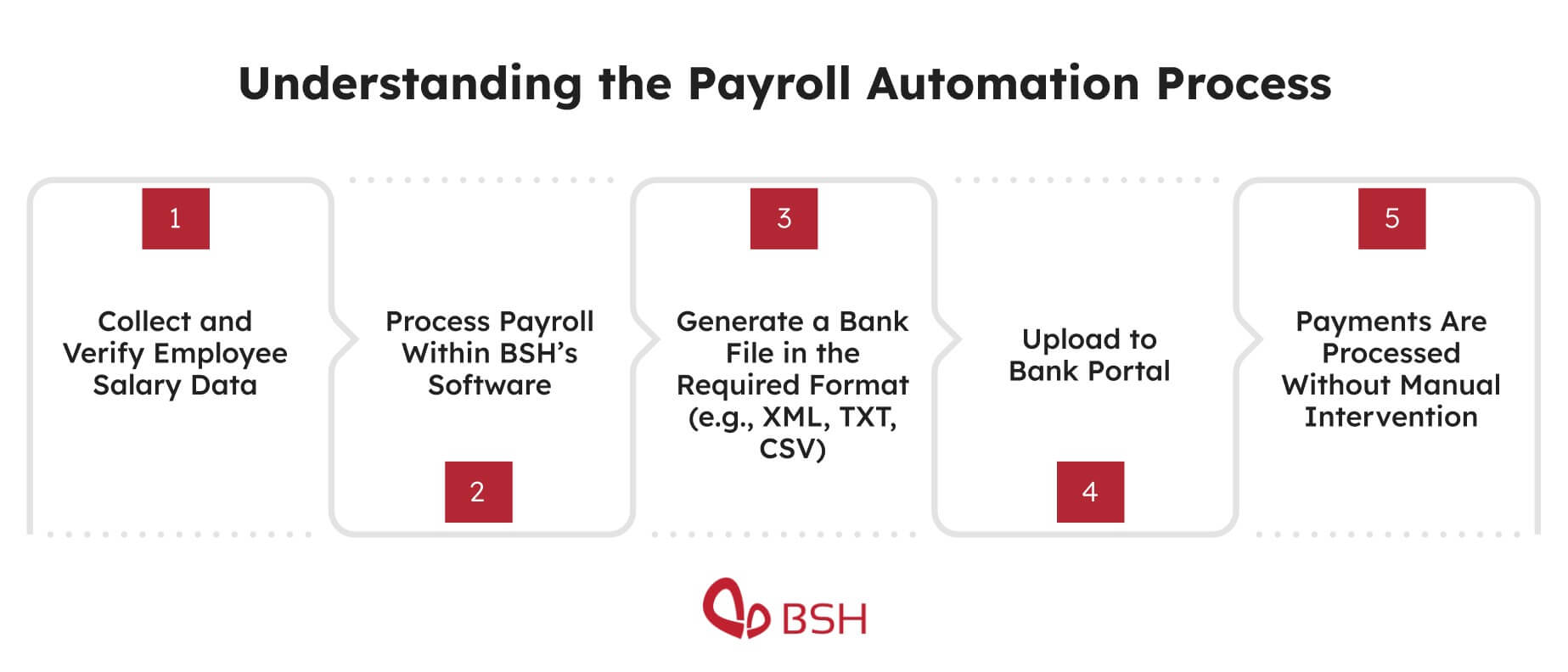

Collect and Verify Employee Salary Data

The payroll process begins by collecting all the relevant information. This includes basic salary data, allowances, deductions, and any applicable bonuses.

All these data are then reviewed and verified to ensure accuracy and compliance with UAE labour laws and other internal company payroll policies.

Any recent changes to employee data, leave adjustments, or contract term modifications are also incorporated at this stage.

Process Payroll Within BSH’s Software

BSH customised payroll software allows the system to automatically calculate each employee’s gross and net salary based on the verified data. It will reflect all mandatory deductions, such as social security contributions, and any additions, including bonuses. Most importantly, it will keep them aligned with WPS.

Generate a Bank File In The Required Format

Next, the BSH customised payroll system will create a bank file containing all the payment instructions. The bank file will follow the format specified by the bank and any other special requirements, such as XML, TXT, or CSV. It will contain key information, such as employee names, bank account numbers, and salary amounts etc. The file undergoes validation checks to minimize errors before submission.

Upload to The Bank Portal

When the custom bank file is validated and approved, it is then securely uploaded to the respective bank’s online portal. This is a crucial step as the bank’s system reads the file and extracts all the salary information for processing.

The customised file format for bank files by BSH eliminates the need for manual data entry or adjustments on the bank portal. It is accurate, fast, and completely eliminates room for errors, guaranteeing that the relevant bank accepts the file without rejection or queries.

These features make payroll simple and efficient for companies managing payroll across multiple banks or for employees with different banking partners.

Payments are Processed Without Manual Intervention

After the file is successfully uploaded, the bank’s automated system will process all the salary transfers in bulk mode. This means that each employee’s salary is credited to their respective bank account according to the custom details provided in the bank file.

With this process, there is no need for manual approvals or individual transactions, which eliminates human errors, reduces administrative workload, and ensures faster salary disbursement overall.

Once the salary transfers are completed, the employers or payroll departments are also notified through real-time status or confirmation reports from the bank portal. This enhances visibility and ensures that all payments are accurately and duly processed.

How BSH Tailors the Format to Your Bank’s Specifications

As one of the leading HCM and payroll solutions providers in the Middle East, at BSH, we fully understand that every bank has its own unique file format and processing requirements. Our payroll system is designed to include custom bank files and automated payroll, allowing organisations to match the exact specifications required by banks, ensuring a seamless integration with the chosen bank for salary disbursements.

Once the custom bank file is developed and implemented according to your organisation's payroll policies and those of the banks involved, we will conduct a thorough testing procedure. This step involves processing both small and controlled transactions to verify that the file, structure, format, and payment logic function as intended and without any legal errors.

The primary purpose of the penny test is to give our clients complete confidence in our automated payroll system and to ensure that the custom bank files work smoothly and accurately before the system goes live.

It is only after our clients are fully satisfied that we roll out the solution on a full scale.

Use Cases: Mainland vs. Freezone Entities

In the UAE, the WPS, a crucial legal framework mandated for employers in the country, varies across mainland and free zone entities.

Mainland UAE

In the UAE mainland, WPS is mandatory for all private sector employers. It mandates salaries to be paid via a WPS through MoHRE-approved banks or exchange houses.

It requires employers to release salaries within 15 days of the due date. Failing to comply with them can lead to severe fines, restrictions on new work permits, and visa renewal blocks.

Free Zones with WPS (DMCC, JAFZA)

DMCC (Dubai Multi Commodities Centre) made WPS mandatory in 2023, with full enforcement (penalties, portal restrictions) from January 2024.

JAFZA (Jebel Ali Free Zone Authority) has made WPS mandatory since 2012. These zones follow rules very similar to the mainland in terms of payment deadlines, WPS-compliant file generation, and fines for non-compliance.

Other Free Zones

WPS is not mandatory unless specified by the zone authority in certain free zones, such as:

DAFZ – Dubai Airport Free Zone

DSO – Dubai Silicon Oasis

SHAMS – Sharjah Media City

RAKEZ – Ras Al Khaimah Economic Zone

Employers typically process salaries via normal bank transfers. In some cases, banks and government authorities may ask for proof of salary payment (bank transfers labeled "salary" or payslips), especially during visa or audit procedures.

Note: Some free zones (like Abu Dhabi Global Market (ADGM) or Dubai International Financial Centre (DIFC)) follow their own employment laws. They are separate from UAE Labour Law and WPS.

How BSH Supports Both Types With Customised Solutions

At BSH, we understand the varying WPS requirements across the UAE mainland and free zones, and automate payroll using custom bank files. We understand that running a business in another country is challenging, especially when it comes to payroll compliance.

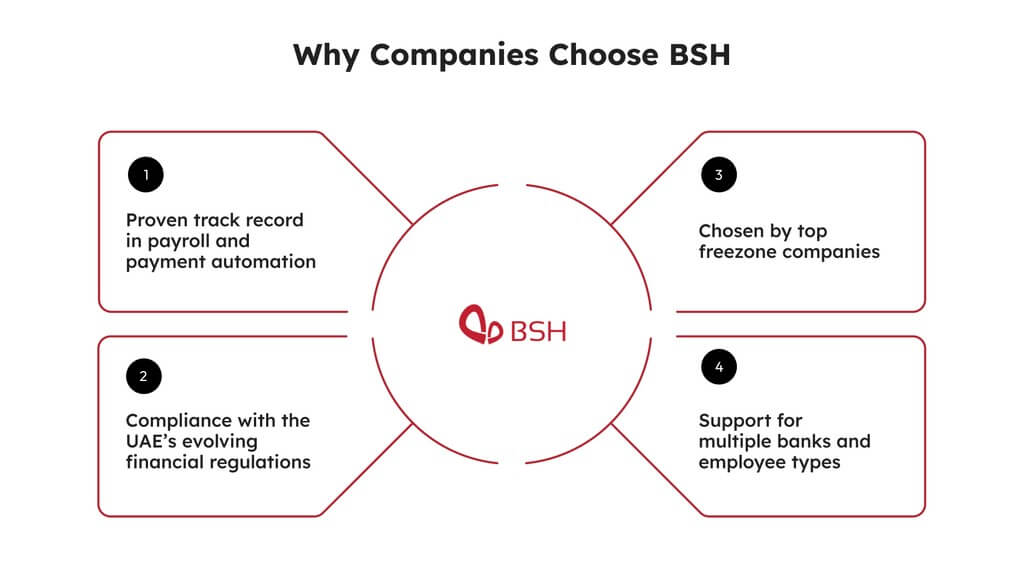

Our tailored approach to HCM and payroll solutions is a key reason why we have become a renowned name among leading businesses in the UAE and the Middle East.

BSH's automated payroll system simplifies payroll for businesses, eliminating the administrative burden, reducing the risk of errors, and minimising the potential for legal breaches, allowing them to focus on other key areas of business operations and growth.

Simplify Payroll with Automation and Custom Bank Files

Automating payroll with custom bank files offers businesses a smarter, faster, and more accurate way to manage salary disbursements. By reducing manual work, eliminating errors, and ensuring full compliance with local regulations like WPS, companies can streamline their entire payroll process while saving valuable time and resources.

As a trusted leader in payroll solutions, BSH provides tailored, bank-compliant file formats and automation tools designed to meet the unique needs of both mainland and free zone entities in the UAE.

Get in touch with BSH today to explore how our solutions can transform your payroll operations, or request a consultation or demo to experience the benefits firsthand.

Payroll processing is a sensitive organisational function in general, as it is strictly regulated by law to uphold the rights of the workforce. Failing to adhere to them can result in negative consequences for a business and the overall reputation of a brand in the labour market.

Especially in the Middle East, there are government-mandated platforms that ensure timely payment of salaries, protect workers' rights, promote employer accountability, reduce disputes, enhance labour market transparency, and prevent the exploitation of vulnerable worker populations in the country. In the UAE, this framework is known as the WPS (Wage Protection System).

Additionally, errors, delays, or unfair salary disbursements can negatively impact employee satisfaction, increase turnover, and expose the business to legal risks.

Traditional, manual payroll methods are time-consuming and prone to mistakes, making them less suitable for growing or large-scale operations.

This blog explores how payroll automation with custom bank files offers a practical solution by streamlining the entire process, from salary calculation to payment execution. It highlights its role in simplifying secure and compliant salary transfers directly through integrated banking systems.

What Are Bank Files and Why Automate Them?

A bank file, in the context of payroll processing, is a thoroughly structured digital document that includes all the essential information required to accurately transfer employees' salaries. It typically includes data such as the employee's name, salary amount, bank details, and payment references.

These files are generated by payroll or accounting software, like the ones offered by BSH, to be compatible with the format specified by the bank. This includes formats such as CSV, TXT, or XML and is uploaded directly to the bank's online portal. Once the payroll is processed by the company, our software generates a bank file containing all the employee payment details in the format required by the bank.

Bank files act as a secure platform between the employer’s payroll system and the banking platforms. It simplifies automated bulk salary payments, eliminating the risk of manual data entry errors and inaccuracies, while also speeding up payment processing.

Most importantly, bank files allow organisations and the payroll department to maintain consistency and improve compliance with systems like the UAE’s WPS and the payroll law of a given country as a whole.

Custom Bank Files: The BSH Advantage

At BSH, we offer custom bank files that are ready-to-use and specifically designed to meet the bank's format requirements and its respective compliance standards. The customisation enables payroll teams to seamlessly integrate them with banking portals, making salary transfers simple, accurate, and efficient.

Whether you are having a business in the mainland or a free zone, our automated payroll solutions are tailored to support various regulatory requirements.

The files generated by our payroll software are fully compatible with multiple banks and payment structures, enabling payroll managers to upload them without requiring manual intervention.

Through our exclusively payroll-customised solutions, we guarantee businesses the confidence to process payroll in line with both UAE compliance guidelines and individual bank requirements.

Our HCM solutions are not restricted to the UAE only. With a consistent legacy spanning over 30 years, we stand as the premier provider of outsourced payroll and HCM solutions throughout the Middle East region.

All our services are customised to carefully reflect the legal frameworks of a given country, while incorporating the unique requirements of banks and the payroll policies of different companies.

What We Offer Through Custom Bank Files

Tailor-made bank file formats as per specific bank requirements (XML, CSV, TXT).

Compatibility with multiple UAE and international banks.

WPS (Wage Protection System) compliant files.

Automated validation to ensure error-free processing.

Ready-to-upload files for direct bank portal submission.

Solutions suitable for both mainland and free zone companies.

Secure handling of employee salary and bank data.

How Payroll Automation Works: Step-by-Step Guide

Collect and Verify Employee Salary Data

The payroll process begins by collecting all the relevant information. This includes basic salary data, allowances, deductions, and any applicable bonuses.

All these data are then reviewed and verified to ensure accuracy and compliance with UAE labour laws and other internal company payroll policies.

Any recent changes to employee data, leave adjustments, or contract term modifications are also incorporated at this stage.

Process Payroll Within BSH’s Software

BSH customised payroll software allows the system to automatically calculate each employee’s gross and net salary based on the verified data. It will reflect all mandatory deductions, such as social security contributions, and any additions, including bonuses. Most importantly, it will keep them aligned with WPS.

Generate a Bank File In The Required Format

Next, the BSH customised payroll system will create a bank file containing all the payment instructions. The bank file will follow the format specified by the bank and any other special requirements, such as XML, TXT, or CSV. It will contain key information, such as employee names, bank account numbers, and salary amounts etc. The file undergoes validation checks to minimize errors before submission.

Upload to The Bank Portal

When the custom bank file is validated and approved, it is then securely uploaded to the respective bank’s online portal. This is a crucial step as the bank’s system reads the file and extracts all the salary information for processing.

The customised file format for bank files by BSH eliminates the need for manual data entry or adjustments on the bank portal. It is accurate, fast, and completely eliminates room for errors, guaranteeing that the relevant bank accepts the file without rejection or queries.

These features make payroll simple and efficient for companies managing payroll across multiple banks or for employees with different banking partners.

Payments are Processed Without Manual Intervention

After the file is successfully uploaded, the bank’s automated system will process all the salary transfers in bulk mode. This means that each employee’s salary is credited to their respective bank account according to the custom details provided in the bank file.

With this process, there is no need for manual approvals or individual transactions, which eliminates human errors, reduces administrative workload, and ensures faster salary disbursement overall.

Once the salary transfers are completed, the employers or payroll departments are also notified through real-time status or confirmation reports from the bank portal. This enhances visibility and ensures that all payments are accurately and duly processed.

How BSH Tailors the Format to Your Bank’s Specifications

As one of the leading HCM and payroll solutions providers in the Middle East, at BSH, we fully understand that every bank has its own unique file format and processing requirements. Our payroll system is designed to include custom bank files and automated payroll, allowing organisations to match the exact specifications required by banks, ensuring a seamless integration with the chosen bank for salary disbursements.

Once the custom bank file is developed and implemented according to your organisation's payroll policies and those of the banks involved, we will conduct a thorough testing procedure. This step involves processing both small and controlled transactions to verify that the file, structure, format, and payment logic function as intended and without any legal errors.

The primary purpose of the penny test is to give our clients complete confidence in our automated payroll system and to ensure that the custom bank files work smoothly and accurately before the system goes live.

It is only after our clients are fully satisfied that we roll out the solution on a full scale.

Use Cases: Mainland vs. Freezone Entities

In the UAE, the WPS, a crucial legal framework mandated for employers in the country, varies across mainland and free zone entities.

Mainland UAE

In the UAE mainland, WPS is mandatory for all private sector employers. It mandates salaries to be paid via a WPS through MoHRE-approved banks or exchange houses.

It requires employers to release salaries within 15 days of the due date. Failing to comply with them can lead to severe fines, restrictions on new work permits, and visa renewal blocks.

Free Zones with WPS (DMCC, JAFZA)

DMCC (Dubai Multi Commodities Centre) made WPS mandatory in 2023, with full enforcement (penalties, portal restrictions) from January 2024.

JAFZA (Jebel Ali Free Zone Authority) has made WPS mandatory since 2012. These zones follow rules very similar to the mainland in terms of payment deadlines, WPS-compliant file generation, and fines for non-compliance.

Other Free Zones

WPS is not mandatory unless specified by the zone authority in certain free zones, such as:

DAFZ – Dubai Airport Free Zone

DSO – Dubai Silicon Oasis

SHAMS – Sharjah Media City

RAKEZ – Ras Al Khaimah Economic Zone

Employers typically process salaries via normal bank transfers. In some cases, banks and government authorities may ask for proof of salary payment (bank transfers labeled "salary" or payslips), especially during visa or audit procedures.

Note: Some free zones (like Abu Dhabi Global Market (ADGM) or Dubai International Financial Centre (DIFC)) follow their own employment laws. They are separate from UAE Labour Law and WPS.

How BSH Supports Both Types With Customised Solutions

At BSH, we understand the varying WPS requirements across the UAE mainland and free zones, and automate payroll using custom bank files. We understand that running a business in another country is challenging, especially when it comes to payroll compliance.

Our tailored approach to HCM and payroll solutions is a key reason why we have become a renowned name among leading businesses in the UAE and the Middle East.

BSH's automated payroll system simplifies payroll for businesses, eliminating the administrative burden, reducing the risk of errors, and minimising the potential for legal breaches, allowing them to focus on other key areas of business operations and growth.

Simplify Payroll with Automation and Custom Bank Files

Automating payroll with custom bank files offers businesses a smarter, faster, and more accurate way to manage salary disbursements. By reducing manual work, eliminating errors, and ensuring full compliance with local regulations like WPS, companies can streamline their entire payroll process while saving valuable time and resources.

As a trusted leader in payroll solutions, BSH provides tailored, bank-compliant file formats and automation tools designed to meet the unique needs of both mainland and free zone entities in the UAE.

Get in touch with BSH today to explore how our solutions can transform your payroll operations, or request a consultation or demo to experience the benefits firsthand.

Frequently asked questions

How do I automate salary payments in the UAE?

How do I automate salary payments in the UAE?

How do I automate salary payments in the UAE?

How do I automate salary payments in the UAE?

What is a bank file for salary payments?

What is a bank file for salary payments?

What is a bank file for salary payments?

What is a bank file for salary payments?

How does payroll automation work in the UAE?

How does payroll automation work in the UAE?

How does payroll automation work in the UAE?

How does payroll automation work in the UAE?

Can I automate employee salary payments in a freezone company?

Can I automate employee salary payments in a freezone company?

Can I automate employee salary payments in a freezone company?

Can I automate employee salary payments in a freezone company?

How to set up automated salary transfers with UAE banks?

How to set up automated salary transfers with UAE banks?

How to set up automated salary transfers with UAE banks?

How to set up automated salary transfers with UAE banks?

Which file formats are accepted for salary payments in the UAE?

Which file formats are accepted for salary payments in the UAE?

Which file formats are accepted for salary payments in the UAE?

Which file formats are accepted for salary payments in the UAE?

Which banks in the UAE accept payroll bank files?

Which banks in the UAE accept payroll bank files?

Which banks in the UAE accept payroll bank files?

Which banks in the UAE accept payroll bank files?

How do I create a compliant bank file for payroll?

How do I create a compliant bank file for payroll?

How do I create a compliant bank file for payroll?

How do I create a compliant bank file for payroll?

Can payroll software generate custom bank files?

Can payroll software generate custom bank files?

Can payroll software generate custom bank files?

Can payroll software generate custom bank files?

What is the easiest way to generate a WPS file for salary?

What is the easiest way to generate a WPS file for salary?

What is the easiest way to generate a WPS file for salary?

What is the easiest way to generate a WPS file for salary?

Should I outsource payroll in the UAE?

Should I outsource payroll in the UAE?

Should I outsource payroll in the UAE?

Should I outsource payroll in the UAE?

What are the benefits of using outsourced payroll services?

What are the benefits of using outsourced payroll services?

What are the benefits of using outsourced payroll services?

What are the benefits of using outsourced payroll services?

Is payroll outsourcing safe for small businesses in Dubai?

Is payroll outsourcing safe for small businesses in Dubai?

Is payroll outsourcing safe for small businesses in Dubai?

Is payroll outsourcing safe for small businesses in Dubai?

Can freezone companies automate payroll through bank files?

Can freezone companies automate payroll through bank files?

Can freezone companies automate payroll through bank files?

Can freezone companies automate payroll through bank files?

Is it safe to outsource payroll in the UAE?

Is it safe to outsource payroll in the UAE?

Is it safe to outsource payroll in the UAE?

Is it safe to outsource payroll in the UAE?

From our blog

Jan 23, 2026

The Importance of International Payroll Services in the UAE

Jan 16, 2026

What Is the Minimum Wage in Dubai? Guide for Employees (2026)

Payroll

Dec 12, 2025

How To Calculate Overtime in the UAE As Per Labour Law (2026)

BSH and the BSH logo are registered trademarks of Business Systems House FZ-LLC | ADP, the ADP logo, and Always Designing for People are trademarks of ADP, Inc.

BSH and the BSH logo are registered trademarks of Business Systems House FZ-LLC | ADP, the ADP logo, and Always Designing for People are trademarks of ADP, Inc.