Payroll

Payroll

Payroll

Payroll

Outsourcing Payroll Guide: How It Works, Benefits, Costs & More

Sep 5, 2025

Outsourcing payroll is an efficient way for businesses to save time, reduce errors, and stay compliant with local labour laws. Whether you’re a small company or a growing enterprise, understanding how to outsource payroll can help you streamline operations and focus on core business goals.

This guide explains how payroll outsourcing works, its key benefits, associated costs, and what to consider before choosing a provider.

What Is Payroll Outsourcing?

Payroll outsourcing refers to engaging an external service provider to manage all payroll-related functions on behalf of your business. These responsibilities may include calculating employee salaries, deducting taxes, ensuring compliance with employment regulations, and administering benefits and deductions. By outsourcing payroll, businesses can concentrate on their core operations while ensuring payroll processes are completed accurately, efficiently, and in line with legal requirements.

How Outsourced Payroll Solutions Work

Outsourced payroll solutions operate by transferring a company’s payroll responsibilities to a specialised third-party provider. The process usually begins with sharing employee details such as salaries, working hours, benefits, and tax information. The provider then calculates wages, processes payments, manages deductions, and ensures compliance with local employment regulations. Most providers use secure, cloud-based software that enables employers to review reports, approve payments, and access real-time payroll data with ease.

Key Benefits of Outsourced Payroll Solutions in Dubai

1. Time and Cost Efficiency

By choosing outsourced payroll solutions in Dubai, businesses save valuable time and reduce operational costs. Experts handle complex payroll tasks, allowing companies to focus on core business growth and strategic objectives.

2. Improved Accuracy and Compliance

A professional outsource payroll service ensures precise salary calculations, correct tax deductions, and full compliance with UAE labour and tax regulations—minimising the risk of penalties or errors.

3. Enhanced Data Security

Trusted providers of HR and payroll outsourcing use encrypted systems, restricted access, and regular audits to safeguard sensitive employee information, ensuring confidentiality and data protection.

4. Scalability and Flexibility

When you outsource your payroll, the service can easily scale to meet business expansion,whether adding new employees, entering new markets, or adapting to changing pay structures.

5. Reduced Compliance Risks

Payroll experts continually monitor UAE employment laws and tax updates, ensuring your payroll remains up to date and compliant with current legislation.

6. Access to Expertise

How to outsource payroll effectively starts with finding a provider skilled in UAE regulations and best practices, offering professional knowledge that enhances accuracy and efficiency.

7. Focus on Core Business Functions

With HR and payroll outsourcing, internal teams can dedicate more time to innovation, client service, and business development while payroll runs smoothly in the background.

Costs of Outsource Payroll Service

The cost of outsourced payroll solutions in Dubai varies depending on several factors, including the size of your workforce, the complexity of payroll requirements, and the range of services you select. Most outsource payroll services charge either a fixed monthly fee or a per-employee rate.

For small businesses, fees may start from a few hundred dirhams per month, while larger companies with more complex structures may pay higher rates. Additional costs can include end-of-service calculations, visa and benefits administration, and year-end reporting.

Although there is an upfront expense, HR and payroll outsourcing often proves more cost-effective than maintaining an in-house payroll team, as it reduces overheads, errors, and compliance-related risks.

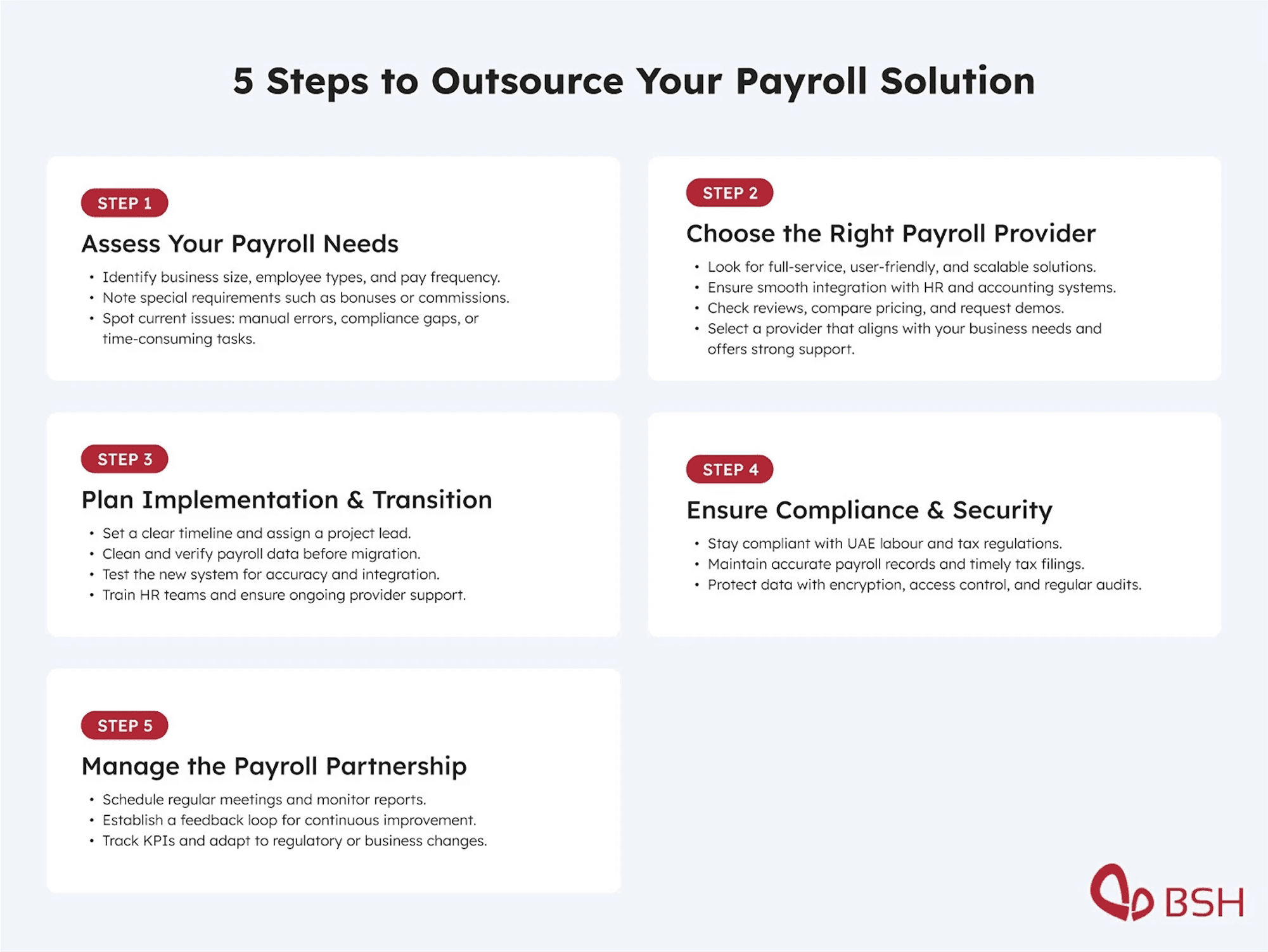

How to Outsource Payroll : Step-By-Step Process

1. Assessing Your Payroll Needs

Understanding Your Business Requirements

Before learning how to outsource payroll, it is vital to assess your specific business needs. Consider factors such as:

Number of Employees: The size of your workforce directly influences the complexity of your payroll operations.

Payroll Frequency: Determine whether employees are paid weekly, bi-weekly, or monthly.

Employee Types: Include full-time, part-time, and contract workers, each with unique pay structures.

Special Payroll Requirements: Consider bonuses, commissions, and overtime payments.

Identifying Pain Points in Your Current Payroll Process

Evaluate your existing system to highlight inefficiencies or challenges, such as:

Manual Errors: Issues arising from manual data entry or miscalculations.

Compliance Challenges: Difficulty keeping pace with evolving UAE labour and tax laws.

Time-Consuming Tasks: Excessive time spent on repetitive payroll duties.

Limited Resources: Insufficient staff or expertise to manage payroll effectively.

2. Choosing the Right Payroll Provider

Key Features to Look For

When selecting an outsource payroll service, look for a provider that offers:

Comprehensive Services: Inclusive of payroll processing, tax filing, benefits management, and direct deposit.

User-Friendly Software: An intuitive system that simplifies payroll management.

Integration Capabilities: Compatibility with your existing HR and accounting systems.

Scalability: The ability to expand services as your business grows.

Reliable Support: Access to responsive and knowledgeable customer service.

Evaluating Payroll Providers

To choose the best HR and payroll outsourcing partner:

Read Reviews: Explore feedback and testimonials from other UAE businesses.

Request Demonstrations: Ask for a system demo to assess its ease of use.

Compare Costs: Analyse detailed pricing and value for money.

Check References: Speak with existing clients to confirm reliability and performance.

Making the Final Decision

After evaluating options, base your decision on:

Service Quality: Proven reliability and accuracy in payroll management.

Value for Money: Transparent pricing aligned with service quality.

Business Alignment: A provider that understands your industry and operational needs.

3. Implementation and Transition

Planning the Transition

A smooth transition is key when you outsource your payroll. Begin by:

Setting Clear Timelines: Establish milestones for each stage of implementation.

Assigning Responsibilities: Appoint a project manager to oversee the transition.

Communicating Internally: Inform employees about the change and address their queries.

Data Migration and Integration

Ensure data accuracy and system compatibility by:

Data Cleansing: Review and verify all employee and payroll data.

Testing the System: Conduct trial runs to detect and resolve issues.

Integrating Systems: Ensure seamless connection with HR and accounting software.

Training and Support

Guarantee an efficient handover through:

Training Sessions: Educate HR teams and employees on the new system.

Ongoing Support: Ensure continuous technical assistance from the provider.

4. Ensuring Compliance and Security

Regulatory Compliance

Understanding how to outsource payroll properly ensures full compliance with UAE employment and tax laws. Key considerations include:

Tax Filing: Accurate and timely submission of payroll taxes.

Labour Law Compliance: Adherence to wage, overtime, and leave regulations.

Record Keeping: Maintaining accurate payroll and employee records.

Data Security Measures

Protecting sensitive payroll information is vital. Choose a provider that employs:

Data Encryption: Secure storage and transmission of payroll data.

Access Control: Restrict access to authorised personnel only.

Regular Audits: Conduct frequent system and data security reviews.

5. Managing the Outsourced Payroll Relationship

Communication and Reporting

Maintain a strong partnership with your payroll provider by:

Regular Updates: Schedule periodic meetings to review performance.

Transparent Reporting: Receive clear, timely payroll summaries and reports.

Feedback Exchange: Create a feedback process to drive continuous improvement.

Continuous Improvement

Optimise your outsourced payroll solutions by:

Monitoring KPIs: Track accuracy, timeliness, and compliance rates.

Gathering Feedback: Seek input from HR staff and employees.

Adapting to Changes: Stay informed about new regulations and adjust processes accordingly.

Simplify Payroll Management with BSH’s Expert Solutions

Outsourcing payroll is more than just a time-saving measure or a compliance necessity, it’s a strategic move that enhances efficiency, accuracy, and peace of mind. By entrusting experts with your payroll, you gain access to secure systems, professional insights, and seamless operations, allowing your business to focus on growth and innovation.

If you’re ready to make your payroll process faster, more reliable, and fully compliant, it’s time to partner with a trusted provider.

BSH offers comprehensive HCM and outsourced payroll solutions designed for businesses of all sizes, from agile startups to large-scale enterprises. With a strong emphasis on data security, regulatory compliance, and transparent processes, BSH helps you streamline operations and stay ahead in today’s competitive market.

Outsourcing payroll is an efficient way for businesses to save time, reduce errors, and stay compliant with local labour laws. Whether you’re a small company or a growing enterprise, understanding how to outsource payroll can help you streamline operations and focus on core business goals.

This guide explains how payroll outsourcing works, its key benefits, associated costs, and what to consider before choosing a provider.

What Is Payroll Outsourcing?

Payroll outsourcing refers to engaging an external service provider to manage all payroll-related functions on behalf of your business. These responsibilities may include calculating employee salaries, deducting taxes, ensuring compliance with employment regulations, and administering benefits and deductions. By outsourcing payroll, businesses can concentrate on their core operations while ensuring payroll processes are completed accurately, efficiently, and in line with legal requirements.

How Outsourced Payroll Solutions Work

Outsourced payroll solutions operate by transferring a company’s payroll responsibilities to a specialised third-party provider. The process usually begins with sharing employee details such as salaries, working hours, benefits, and tax information. The provider then calculates wages, processes payments, manages deductions, and ensures compliance with local employment regulations. Most providers use secure, cloud-based software that enables employers to review reports, approve payments, and access real-time payroll data with ease.

Key Benefits of Outsourced Payroll Solutions in Dubai

1. Time and Cost Efficiency

By choosing outsourced payroll solutions in Dubai, businesses save valuable time and reduce operational costs. Experts handle complex payroll tasks, allowing companies to focus on core business growth and strategic objectives.

2. Improved Accuracy and Compliance

A professional outsource payroll service ensures precise salary calculations, correct tax deductions, and full compliance with UAE labour and tax regulations—minimising the risk of penalties or errors.

3. Enhanced Data Security

Trusted providers of HR and payroll outsourcing use encrypted systems, restricted access, and regular audits to safeguard sensitive employee information, ensuring confidentiality and data protection.

4. Scalability and Flexibility

When you outsource your payroll, the service can easily scale to meet business expansion,whether adding new employees, entering new markets, or adapting to changing pay structures.

5. Reduced Compliance Risks

Payroll experts continually monitor UAE employment laws and tax updates, ensuring your payroll remains up to date and compliant with current legislation.

6. Access to Expertise

How to outsource payroll effectively starts with finding a provider skilled in UAE regulations and best practices, offering professional knowledge that enhances accuracy and efficiency.

7. Focus on Core Business Functions

With HR and payroll outsourcing, internal teams can dedicate more time to innovation, client service, and business development while payroll runs smoothly in the background.

Costs of Outsource Payroll Service

The cost of outsourced payroll solutions in Dubai varies depending on several factors, including the size of your workforce, the complexity of payroll requirements, and the range of services you select. Most outsource payroll services charge either a fixed monthly fee or a per-employee rate.

For small businesses, fees may start from a few hundred dirhams per month, while larger companies with more complex structures may pay higher rates. Additional costs can include end-of-service calculations, visa and benefits administration, and year-end reporting.

Although there is an upfront expense, HR and payroll outsourcing often proves more cost-effective than maintaining an in-house payroll team, as it reduces overheads, errors, and compliance-related risks.

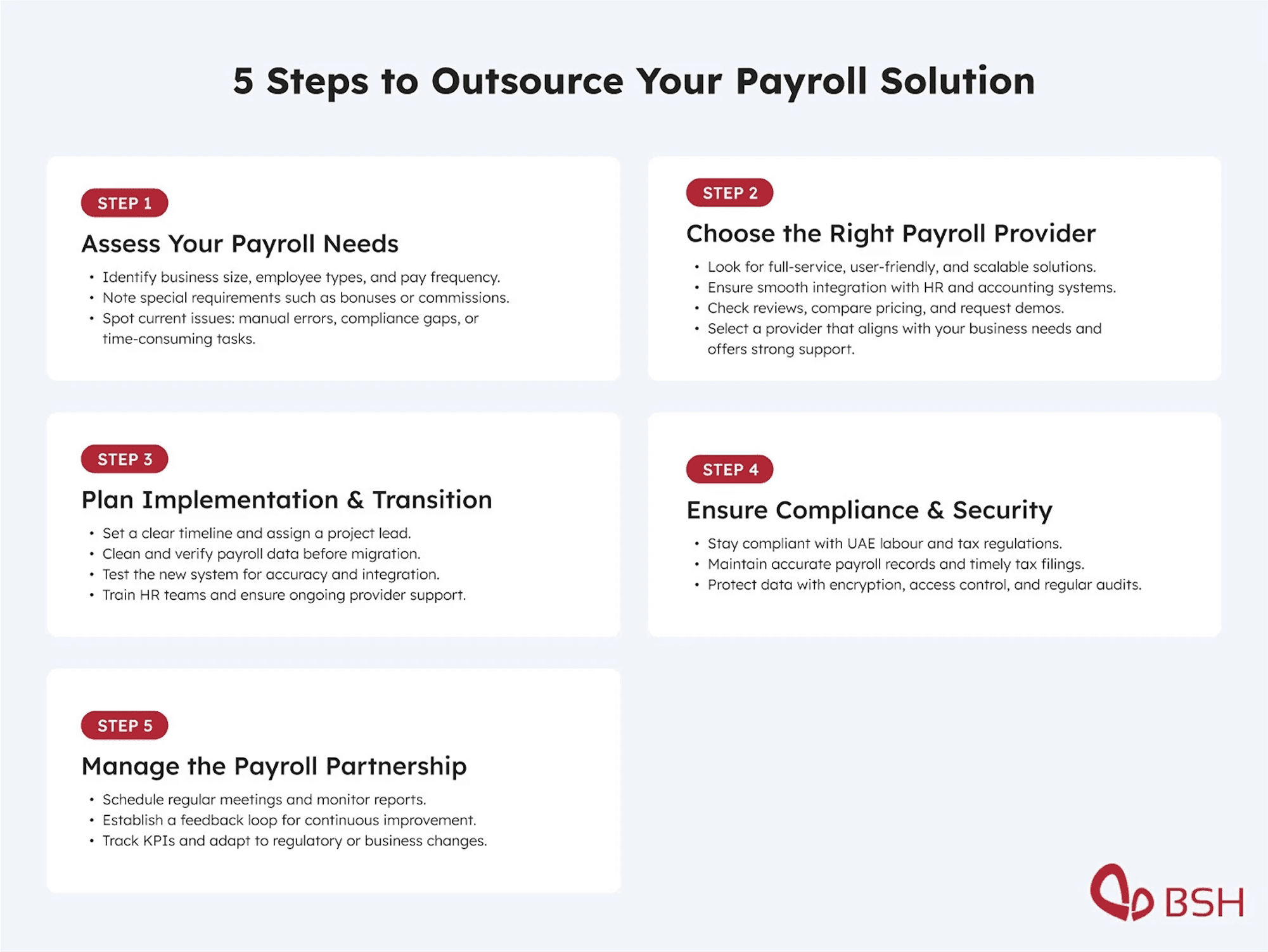

How to Outsource Payroll : Step-By-Step Process

1. Assessing Your Payroll Needs

Understanding Your Business Requirements

Before learning how to outsource payroll, it is vital to assess your specific business needs. Consider factors such as:

Number of Employees: The size of your workforce directly influences the complexity of your payroll operations.

Payroll Frequency: Determine whether employees are paid weekly, bi-weekly, or monthly.

Employee Types: Include full-time, part-time, and contract workers, each with unique pay structures.

Special Payroll Requirements: Consider bonuses, commissions, and overtime payments.

Identifying Pain Points in Your Current Payroll Process

Evaluate your existing system to highlight inefficiencies or challenges, such as:

Manual Errors: Issues arising from manual data entry or miscalculations.

Compliance Challenges: Difficulty keeping pace with evolving UAE labour and tax laws.

Time-Consuming Tasks: Excessive time spent on repetitive payroll duties.

Limited Resources: Insufficient staff or expertise to manage payroll effectively.

2. Choosing the Right Payroll Provider

Key Features to Look For

When selecting an outsource payroll service, look for a provider that offers:

Comprehensive Services: Inclusive of payroll processing, tax filing, benefits management, and direct deposit.

User-Friendly Software: An intuitive system that simplifies payroll management.

Integration Capabilities: Compatibility with your existing HR and accounting systems.

Scalability: The ability to expand services as your business grows.

Reliable Support: Access to responsive and knowledgeable customer service.

Evaluating Payroll Providers

To choose the best HR and payroll outsourcing partner:

Read Reviews: Explore feedback and testimonials from other UAE businesses.

Request Demonstrations: Ask for a system demo to assess its ease of use.

Compare Costs: Analyse detailed pricing and value for money.

Check References: Speak with existing clients to confirm reliability and performance.

Making the Final Decision

After evaluating options, base your decision on:

Service Quality: Proven reliability and accuracy in payroll management.

Value for Money: Transparent pricing aligned with service quality.

Business Alignment: A provider that understands your industry and operational needs.

3. Implementation and Transition

Planning the Transition

A smooth transition is key when you outsource your payroll. Begin by:

Setting Clear Timelines: Establish milestones for each stage of implementation.

Assigning Responsibilities: Appoint a project manager to oversee the transition.

Communicating Internally: Inform employees about the change and address their queries.

Data Migration and Integration

Ensure data accuracy and system compatibility by:

Data Cleansing: Review and verify all employee and payroll data.

Testing the System: Conduct trial runs to detect and resolve issues.

Integrating Systems: Ensure seamless connection with HR and accounting software.

Training and Support

Guarantee an efficient handover through:

Training Sessions: Educate HR teams and employees on the new system.

Ongoing Support: Ensure continuous technical assistance from the provider.

4. Ensuring Compliance and Security

Regulatory Compliance

Understanding how to outsource payroll properly ensures full compliance with UAE employment and tax laws. Key considerations include:

Tax Filing: Accurate and timely submission of payroll taxes.

Labour Law Compliance: Adherence to wage, overtime, and leave regulations.

Record Keeping: Maintaining accurate payroll and employee records.

Data Security Measures

Protecting sensitive payroll information is vital. Choose a provider that employs:

Data Encryption: Secure storage and transmission of payroll data.

Access Control: Restrict access to authorised personnel only.

Regular Audits: Conduct frequent system and data security reviews.

5. Managing the Outsourced Payroll Relationship

Communication and Reporting

Maintain a strong partnership with your payroll provider by:

Regular Updates: Schedule periodic meetings to review performance.

Transparent Reporting: Receive clear, timely payroll summaries and reports.

Feedback Exchange: Create a feedback process to drive continuous improvement.

Continuous Improvement

Optimise your outsourced payroll solutions by:

Monitoring KPIs: Track accuracy, timeliness, and compliance rates.

Gathering Feedback: Seek input from HR staff and employees.

Adapting to Changes: Stay informed about new regulations and adjust processes accordingly.

Simplify Payroll Management with BSH’s Expert Solutions

Outsourcing payroll is more than just a time-saving measure or a compliance necessity, it’s a strategic move that enhances efficiency, accuracy, and peace of mind. By entrusting experts with your payroll, you gain access to secure systems, professional insights, and seamless operations, allowing your business to focus on growth and innovation.

If you’re ready to make your payroll process faster, more reliable, and fully compliant, it’s time to partner with a trusted provider.

BSH offers comprehensive HCM and outsourced payroll solutions designed for businesses of all sizes, from agile startups to large-scale enterprises. With a strong emphasis on data security, regulatory compliance, and transparent processes, BSH helps you streamline operations and stay ahead in today’s competitive market.

Frequently asked questions

Is outsourcing profitable?

Is outsourcing profitable?

Is outsourcing profitable?

Is outsourcing profitable?

What is outsourcing payroll?

What is outsourcing payroll?

What is outsourcing payroll?

What is outsourcing payroll?

What is a BPO in payroll?

What is a BPO in payroll?

What is a BPO in payroll?

What is a BPO in payroll?

Is outsourcing part of HR?

Is outsourcing part of HR?

Is outsourcing part of HR?

Is outsourcing part of HR?

What is a payroll audit?

What is a payroll audit?

What is a payroll audit?

What is a payroll audit?

From our blog

Jan 23, 2026

The Importance of International Payroll Services in the UAE

Jan 16, 2026

What Is the Minimum Wage in Dubai? Guide for Employees (2026)

Payroll

Dec 12, 2025

How To Calculate Overtime in the UAE As Per Labour Law (2026)

BSH and the BSH logo are registered trademarks of Business Systems House FZ-LLC | ADP, the ADP logo, and Always Designing for People are trademarks of ADP, Inc.

BSH and the BSH logo are registered trademarks of Business Systems House FZ-LLC | ADP, the ADP logo, and Always Designing for People are trademarks of ADP, Inc.